Little Known Questions About Estate Planning Attorney.

Little Known Questions About Estate Planning Attorney.

Blog Article

Excitement About Estate Planning Attorney

Table of ContentsSome Ideas on Estate Planning Attorney You Need To KnowGetting My Estate Planning Attorney To WorkFascination About Estate Planning AttorneyAn Unbiased View of Estate Planning Attorney

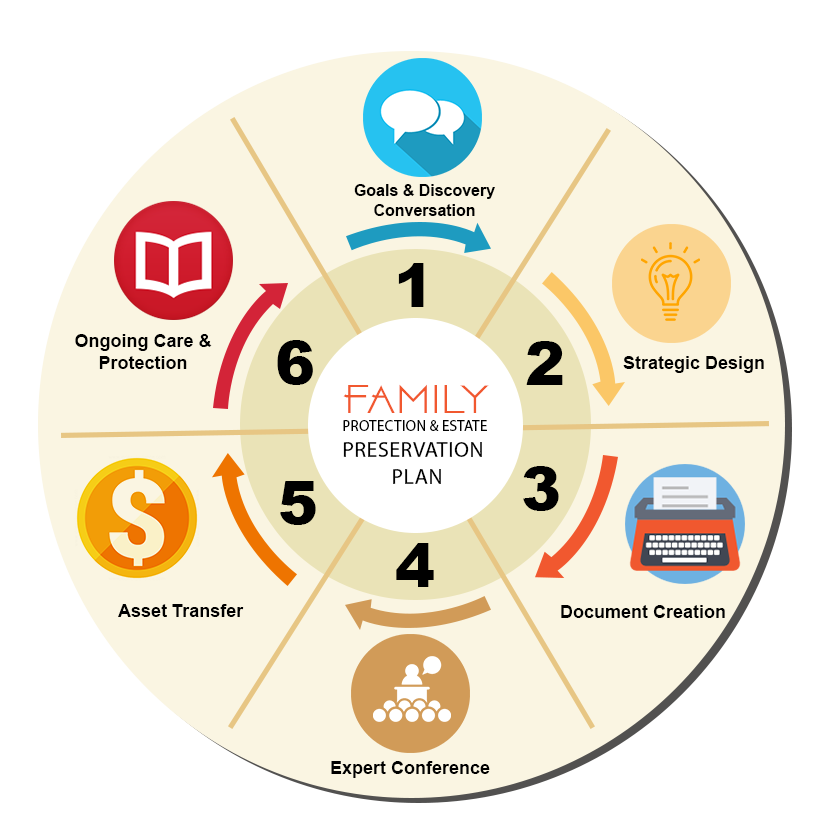

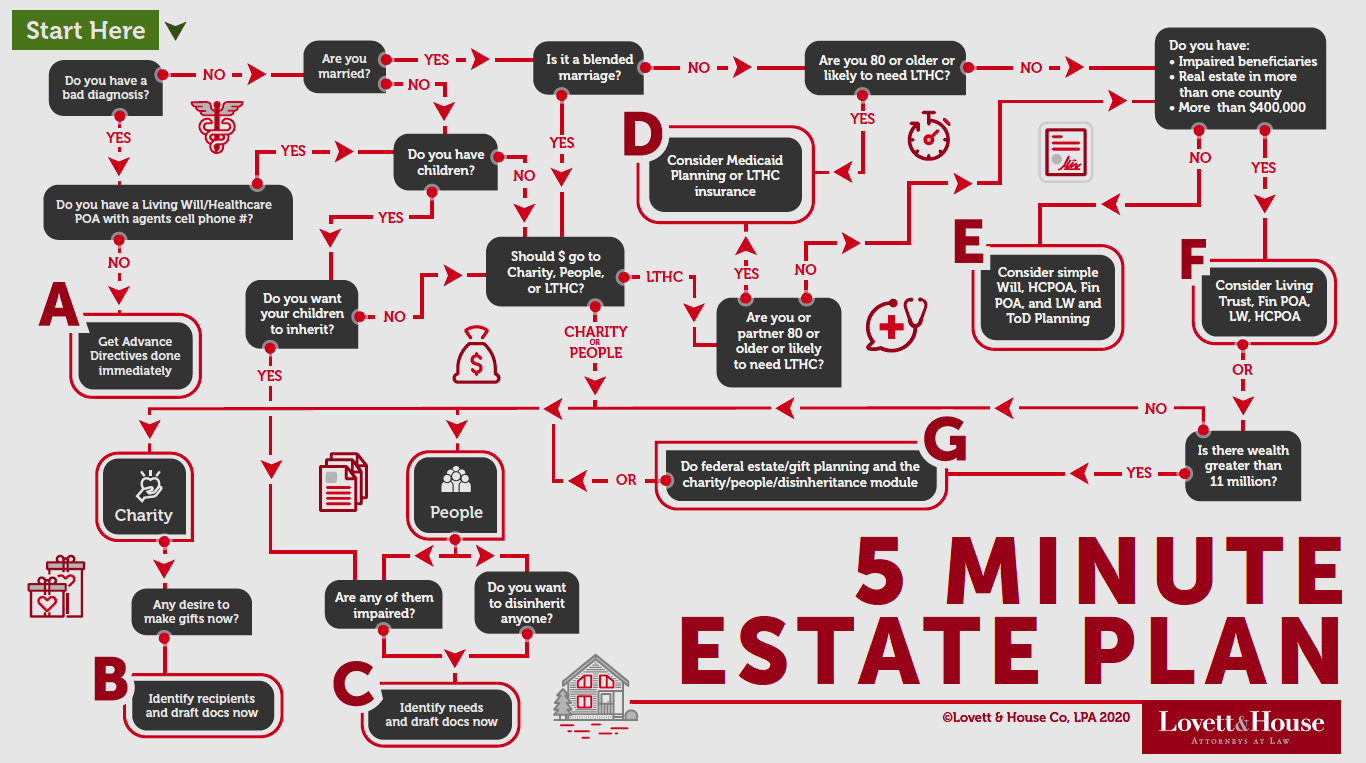

Estate planning is an activity plan you can make use of to determine what occurs to your assets and commitments while you're active and after you die. A will, on the other hand, is a lawful document that details just how properties are distributed, that takes treatment of children and family pets, and any kind of other desires after you pass away.

The executor additionally has to repay any type of taxes and financial debt owed by the deceased from the estate. Creditors generally have a restricted amount of time from the date they were notified of the testator's death to make insurance claims against the estate for cash owed to them. Claims that are turned down by the executor can be brought to justice where a probate court will have the last word as to whether the claim is valid.

Excitement About Estate Planning Attorney

After the inventory of the estate has been taken, the worth of properties calculated, and taxes and financial obligation repaid, the administrator will certainly then seek permission from the court to distribute whatever is left of the estate to the recipients. Any kind of inheritance tax that are pending will certainly come due within 9 months of the day of fatality.

Each individual areas their assets in the count on and names somebody other than their spouse as the beneficiary., to support grandchildrens' education.

The Ultimate Guide To Estate Planning Attorney

Estate coordinators can collaborate with the donor in order to reduce taxable revenue as a result of those payments or formulate strategies that make best use of the result of those contributions. This is one more technique that can be used to restrict death taxes. It entails a private securing the present value, and hence tax obligation obligation, of their building, while connecting the value of future development of that funding to another individual. This technique involves cold the value of a property at its value on the day of transfer. Appropriately, the amount of possible capital gain at fatality is likewise iced up, enabling the estate planner to approximate their potential tax obligation liability upon fatality and better strategy for the payment of revenue taxes.

If enough insurance coverage proceeds are offered and the policies are appropriately structured, any revenue tax on the considered dispositions of possessions adhering to the death of an individual can be paid without turning to the sale of assets. Earnings from life insurance policy that are gotten by the recipients upon the fatality of the insured are normally income tax-free.

There are certain files you'll require as component of the estate preparation procedure. Some of the most common ones include wills, powers of attorney (POAs), guardianship classifications, and living wills.

There is a myth that estate planning is just for high-net-worth people. Estate intending makes it less complicated for people to establish their dreams prior to and after they pass away.

Indicators on Estate Planning Attorney You Should Know

You ought to start preparing for your estate as soon as you have any type of measurable asset base. It's a continuous process: as life proceeds, your estate plan should move look at these guys to match your situations, in line with your brand-new goals.

Estate planning is commonly assumed of as a tool for the affluent. Estate preparation is also a terrific method for you to lay out strategies for the care of your minor kids and pet dogs and to detail your wishes for your funeral and favored charities.

Qualified applicants that pass the exam will be formally certified in August. If you're qualified to sit for the examination from a previous application, you might file the brief application.

Report this page